Social Security Turns 90 Today; But Trustees Warn Your Benefits May Not Survive To 100 – Financial Freedom Countdown

Today marks the 90th anniversary of Social Security, a program that has kept millions of Americans out of poverty for generations.

But while the monthly checks remain a lifeline for retirees, new warnings from the program’s trustees show that drastic changes could be coming within less than a decade; unless Congress acts soon.

A Program Born in the Great Depression

When President Franklin D. Roosevelt signed the Social Security Act into law in 1935, it was meant to provide a safety net for seniors who might otherwise fall into poverty.

Over time, Congress expanded the program to cover nearly all Americans, turning it into one of the country’s most significant income-replacement systems.

From Anti-Poverty Plan to Nationwide Pension

Today, Social Security isn’t just for the most vulnerable; it’s the primary retirement income source for tens of millions.

Very different from how the program was originally intended; it is now primarily an income replacement program for working Americans, regardless of need.

How Benefits Are Calculated

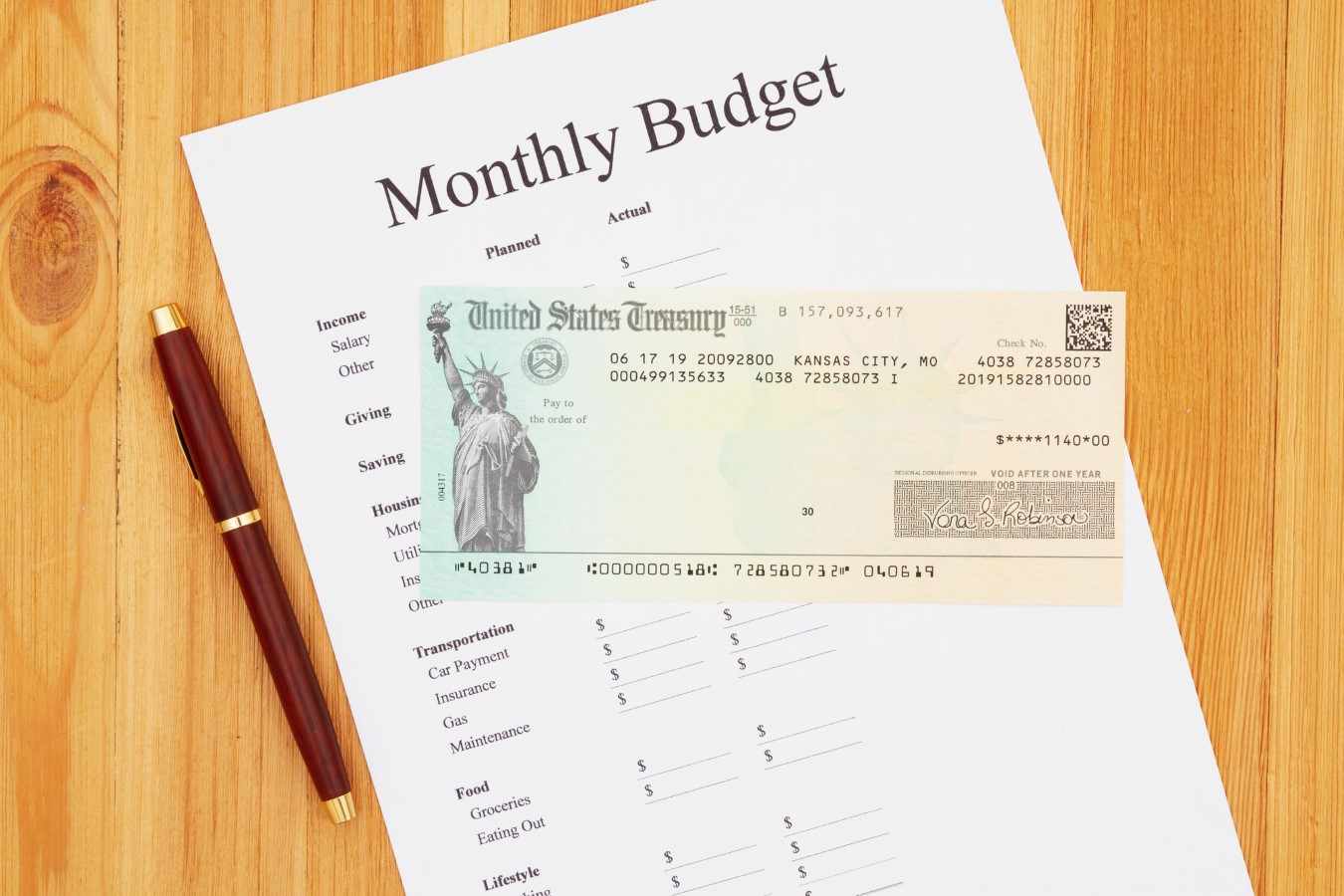

Your monthly benefit depends on your lifetime earnings, the years you worked, and broader economic growth.

Currently, the average Old-Age and Survivors Insurance (OASI) payment is about $1,900 per month, though the highest earners can collect up to $5,000.

The Cash Flow Crisis

For years, Social Security has been paying out more in benefits than it takes in from payroll taxes.

Many Americans mistakenly believe there’s a personal account with their name on it; but in reality, today’s benefits are paid directly from taxes collected from current workers.

The 2033 Deadline

The latest Social Security Trustees Report warns that the OASI Trust Fund will be depleted by 2033.

At that point, incoming payroll taxes would only cover 77% of scheduled benefits; meaning an across-the-board cut of 23% if Congress doesn’t act.

Disability Benefits Are Safe — For Now

The Disability Insurance (DI) Trust Fund is projected to remain solvent through at least 2099, but when combined with OASI for overall projections, the depletion date for the combined OASDI fund is just 2034; one year earlier than last year’s forecast.

Medicare Faces Its Own Clock

The Hospital Insurance (HI) Trust Fund, which funds Medicare Part A, will run dry in 2033, three years earlier than previously projected.

Even then, incoming funds would still cover 89% of scheduled benefits.

What Changed Since Last Year

Three major factors worsened Social Security’s outlook this year:

Congress repealed the Windfall Elimination Provision and Government Pension Offset, increasing future benefits for government workers. The Social Security Fairness Act was signed into law by Biden in his final weeks as the President.

The Trustees extended the expected recovery in birth rates by 10 years, slowing the growth of the workforce.

A lower share of GDP is now expected to go to worker wages, reducing payroll tax revenue.

Possible Fixes on the Table

Ideas to fix Social Security’s finances include:

Raising the full retirement age

Changing benefit formulas

Reducing benefits for high-income retirees

Raising or eliminating the payroll tax cap

Experts argues the easiest fix is to trim benefits for the highest earners, preserving payments for the most vulnerable without adding to debt or tax burdens for younger Americans.

Lawmakers Say Bipartisanship Is Key

To enact any changes to Social Security, at least 60 seats are needed in the Senate. No party in the last few decades has received enough seats. Hence, any changes will need to be bipartisan.

History shows bipartisan cooperation is possible. In the 1980s, a special commission’s recommendations led to major reforms signed by President Ronald Reagan.

The Cost of Waiting

Experts warn that delaying action will make solutions more painful.

Acting early allows for gradual changes, giving future retirees more time to plan and adjust.

The Bottom Line for Today’s Seniors

If Congress doesn’t find a solution, retirees could face benefit cuts within eight to nine years. For those relying on Social Security as their main source of income, that could mean hundreds of dollars less each month; a reality that underscores just how urgently Washington needs to act.

Like Financial Freedom Countdown content? Be sure to follow us!

Starting August, the Social Security Administration begins clawing back overpaid benefits at a dramatically faster pace; slashing monthly payments by 50% for recipients with outstanding debts. The abrupt policy change, which affects hundreds of thousands of Americans, is part of the agency’s latest effort to recover an estimated $32.8 billion in overpayments made between 2020 and 2023. While only a small percentage of total recipients are impacted, those affected could now see half their monthly checks vanish; raising serious concerns about hardship among retirees and disabled Americans who rely on Social Security for basic living expenses.

Starting This Month, Social Security Slashes Checks by 50% for Overpaid Retirees

The Social Security Administration (SSA) has announced that paper checks will no longer be issued starting September 30, 2025, in a major modernization move led by the Trump administration. This change is part of a broader government effort to reduce fraud, improve efficiency, and save taxpayer dollars.

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.