Compliance Without Borders: The Engine Behind Harmonized Reporting Across Jurisdictions

In an economy where institutions are active in numerous regulatory jurisdictions, reporting consistently and accurately across jurisdictions has emerged as a characteristic challenge. With systems like FR Y-9C in the United States, IFRS 9 in international markets, and FINREP in the European Union, banks have to juggle conflicting compliance requirements—without sacrificing operational agility or data integrity.

This is no longer a policy issue—it is an issue of architecture. Legacy systems, data storage facilities that are kept separate, and manual reunification workflows are not built to handle an increasing number of regulatory demands. To meet these needs, new institutions are rethinking how data should move, connect, and fit in with changing standards on a large scale.

One of the most creative and enterprise-level solutions to this issue has been the Regulatory Data Harmonization and Integration Model (RDHIM)—a revolutionary architecture created explicitly to consolidate regulatory reporting across geographies, legal entities, and compliance regimes.

From Complexity to Coherence: The Birth of RDHIM

In essence, RDHIM is more than a technology solution; it is a governance-first design that reconciles compliance information through custom-built extensions to Data Vault 2.0. It adds automated lineage capture, SHA-256-based entity resolution, and cross-standard reconcile logic—providing a Single Source Of Truth (SSOT) that can evolve for multiple regulatory regimes in real time.

What sets RDHIM apart is its design. Unlike repurposed BI tools or post-hoc data platforms, it was built from the ground up to address one of the most unsolved issues in contemporary banking: multi-jurisdictional regulatory fragmentation.

Banks using RDHIM today can report in parallel under various frameworks simultaneously without duplicated workflow or duplicated infrastructure—reducing costs, removing vulnerabilities, and enhancing audit readiness.

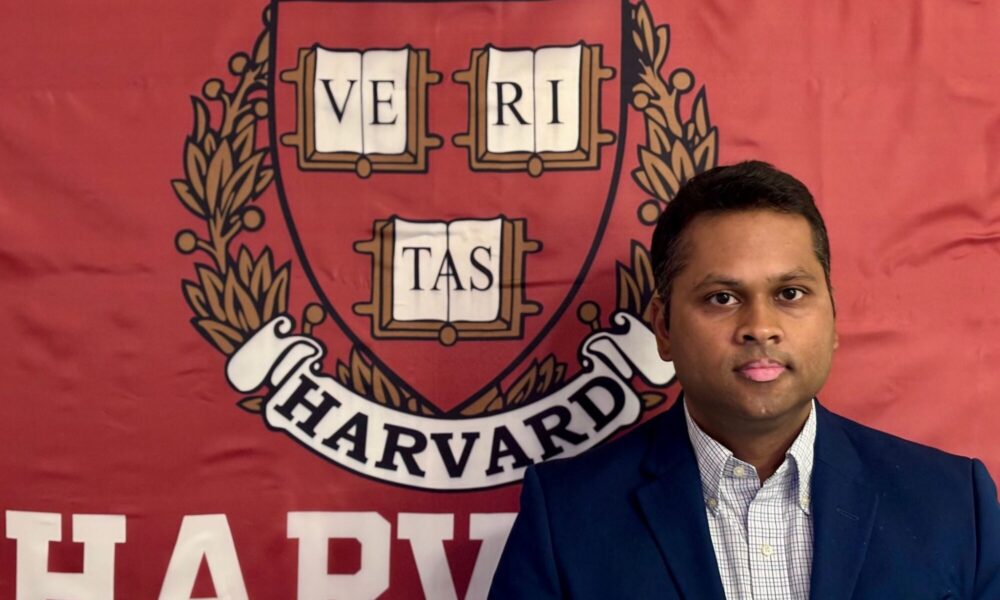

Ohm Hareesh Kundurthy: The Architect Behind the Architecture

Behind the creation and successful implementation of RDHIM is Ohm Hareesh Kundurthy, a visionary data architect and Director of Application Development for Santander Bank. With more than 18 years of experience in enterprise system transformation and compliance-driven application design, Ohm envisioned, developed, and deployed RDHIM from scratch.

This was not an assignment-based effort. It was initiated, formulated, and implemented by Ohm in his individual capacity—a distinctive effort that combined technical innovation, program management rigor, and regulatory acumen. His framework not only automated compliance but set new standards for what compliance architecture has the potential to be in a $150B bank.

Under Ohm, RDHIM was rolled out over three legal entities between 2022 and 2025. His duties involved developing the architecture to support CDC (Change Data Capture) logic, semantic reconciliation mappings, and end-to-end lineage tracking that enabled the system to be fully auditable.

The outcomes were quantifiable:

1. 100% audit readiness

2. ~20% increase in workflow effectiveness

3. Removal of several medium vulnerabilities

4. Roadmap for scalability to other G-SIBs

These results address not just the effectiveness of the system but also Ohm’s unique talent for closing theory and practice, tying principles from DAMA-DMBOK, Basel, TOGAF, and Data Vault to enterprise-scale deployment.

A Framework That Complements RegTech 2.0

The value of RDHIM goes far beyond any individual institution. It is a move toward technocratic governance in whichcompliance is not bolted on but intrinsic to the data model.

This is consistent with the emerging RegTech 2.0 mindset, which focuses on:

1. Automated lineage rather than manual traceability

2. Semantic consistency across borders

3. Compliance by design and not patchwork

Regulatory platforms in this new era need to be adaptive, explainable, and interoperable. RDHIM satisfies all three—making it a future reference architecture for multinational banks struggling with global compliance complexity.

For institutions and professionals to ride out the choppy waters of digital regulation, RDHIM provides not only a lifeline—but a road map for sustainable government.

The Man Shaping the Future of Financial Compliance

What puts Ohm Kundurthy among the best in data architecture isn’t his technical expertise—it’s his perspective for the larger picture. As a Distinguished Fellow at SCRS, an IEEE Senior Member, and Fellow of IETE, his work ranges from academic research, enterprise system delivery, and strategic advisory.

He has consistently translated high-level theoretical constructs into live, working systems—demonstrating that fintechinnovation is less about flash, but about depth, accuracy, and discipline.

Ohm’s LinkedIn summary is like a masterclass in regulatory evolution, but his actual contribution is to create systems that hold up to audits, time, and change.

Conclusion

As regulations in global banking continue to change, the banks that will succeed are those that can evolve without fragmentation. They will require architectures that scale, comply, and audit—without concession.

The achievement of Ohm Hareesh Kundurthy is a testament to what is achievable when innovation combines with governance. RDHIM is not just a solution—it is a dream materialized, and a platform upon which the future of regulatory technology shall be built. Compliance has no borders in today’s world. Leaders who plan beyond borders will make the future.

Source: Compliance Without Borders: The Engine Behind Harmonized Reporting Across Jurisdictions